An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect.[1]

An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is imposed. Some commentators have argued that “a direct tax is one that cannot be charged by the taxpayer to someone else, whereas an indirect tax can be.”[2]

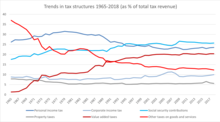

Trends in Tax Structures in OECD Countries[3]

Tax structure per OECD country in 2018.[4]

Indirect taxes constitute a significant proportion of total tax revenue raised by the government. Data published by OECD show that the average indirect tax share of total tax revenue for all member countries in 2018 was 32.7% with standard deviation 7.9%. The member country with the highest share was Chile with 53.2% and at the other end was USA with 17.6%.[5] The general trend in direct vs indirect tax ratio in total tax revenue over past decades in developed countries shows an increase in direct tax share of total tax revenue. Although this trend is also observed in developing countries, the trend is less pronounced there than in developed countries.[6]